GT Resources Adds Greenstone Hosted Gold and Nickel to Finland Portfolio

February 17, 2026 – Toronto, Ontario – GT Resources Inc. (TSX-V: GT, OTCQB: CGTRF, FRA: 7N1) (the “Company” or “GT”) is pleased to announce the acquisition, through staking, of the Kuhmo Gold Project in central Finland. The project covers 12,300 hectares of the highly prospective Kuhmo greenstone belt, located 130 km southeast of the Company’s flagship Läntinen Koillismaa (“LK”) Project (Figure 1).

Highlights

- Near-Term Discovery Opportunity: Widespread gold-in-till anomalies largely unexplained and drill-ready.

- High-Grade Till Anomalies: Gold-in-till samples up to 45,800 ppb.

- Proof of Concept: Limited historic drilling includes 11.4 g/t gold over 0.9m (Hole SMS/LEL_1) and 2.3 g/t gold over 4.7m (Hole MEN036).

- Geological Analogues: Hallmarks of “orogenic gold” such as belt-parallel faults and late clastic sediments structurally analogous to “Temiskaming-type” sediments of the world-class Abitibi Subprovince.

- Poly-Metallic Potential: The Kuhmo Project hosts a known nickel endowment, including the Arola historical mineral resource1 of 1.5M tonne grading 0.46% nickel.

- Strategic Land Position: 12,300 ha of the Kuhmo ‘greenstone belt’ via two Exploration Reservations; no overlap with Natura 2000 protected areas.

- Operational Synergies: Proximity to the Company’s flagship LK Project allows cost-efficiencies through an established technical team, local infrastructure, and exploration logistics. This regional “cluster” strategy maximizes the value of exploration dollars spent.

- Infrastructure Advantage: Excellent year-round access via paved/gravel roads and proximity to rail and the port city of Oulu.

- Finland: A Premier Mining-Friendly Jurisdiction.

- Competitive Advantage: Historic state-run exploration focused on nickel to feed Finland’s industrial complex, this legacy not only defined many gold-in-till anomalies but left them largely untested.

Neil Pettigrew Vice President of Exploration, states: “Khumo has many similarities to the prolific greenstone hosted gold in the Abitibi Subprovince of Canada. Furthermore, the belt has been covered with in excess of 22,000 high quality regional till samples, a result of state-run mineral exploration focused on nickel, providing GT with numerous untested gold targets. This is a rare opportunity to accelerate the lead time to discovery in an overlooked greenstone belt. Our strategy is akin to what Kenorland Minerals Ltd.’s has accomplished in Canada”.

Geology of the Kuhmo Belt

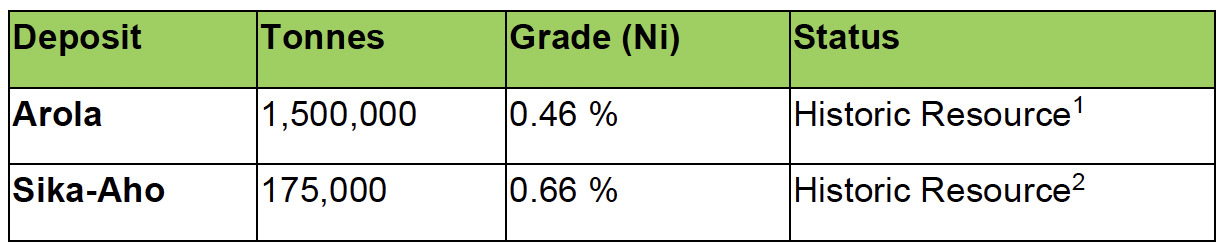

The Archean-aged Kuhmo greenstone belt is a 220 km long complex in eastern central Finland (Figures 1 and 2). While historically noted for its nickel, GT Resources has identified the belt as a premier target for orogenic and intrusion-related gold.

The belt features a structural setting remarkably similar to Canada’s Abitibi Subprovince. The Ronkaperä formation sandstones and conglomerates were deposited in basins along major north-south faults 60-90 million years after the main stage of volcanism. These “Temiskaming-type” sediments act as a major vector for gold exploration, marking the deep-seated “Breaks” that served as primary conduits for gold mineralization.

Gold Mineralization

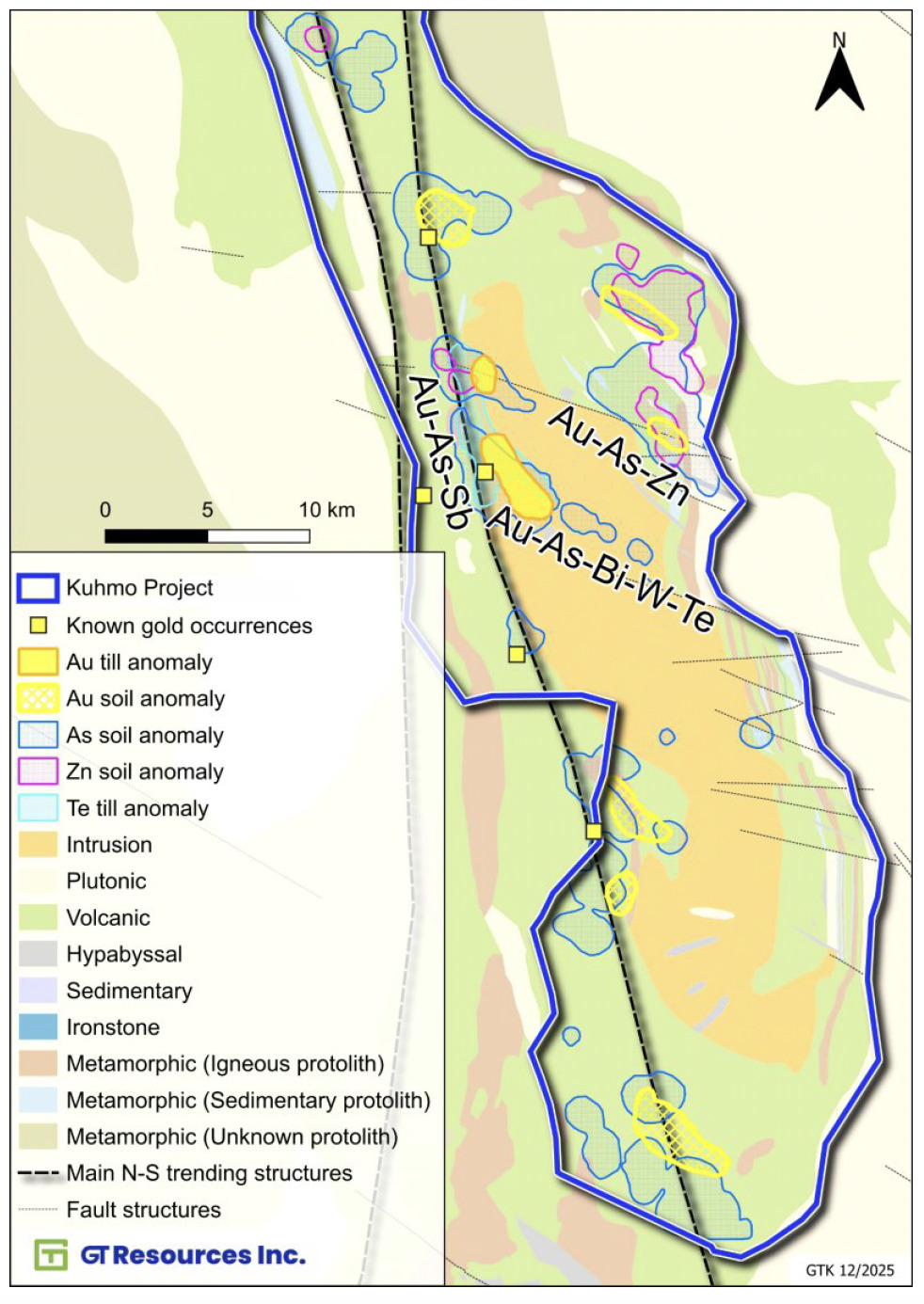

The Kuhmo Project exhibits the hallmarks of a major orogenic gold system, including belt-scale faults and splays providing fluid conduits and dilation zones, arsenopyrite and quartz-tourmaline alteration, and a diverse mix of prospective lithologies (komatiites, tholeiitic basalts, felsic volcanics, clastic sediments, iron formation and felsic intrusive stocks), (Figure 2, Table 1).

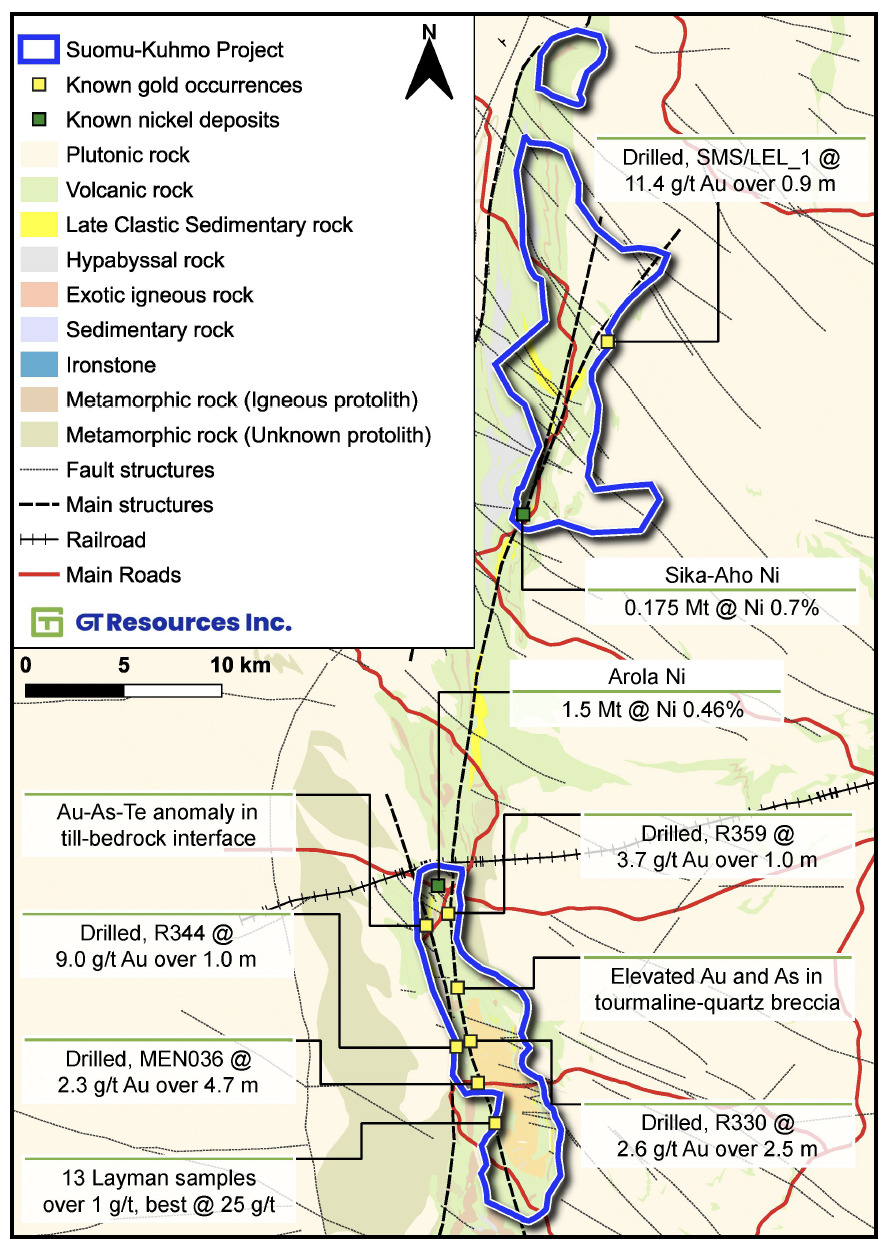

Geochemical Vectoring: Why Arsenic is Good

In Archean orogenic gold systems, arsenic often proves to be a critical “pathfinder” element. Gold and arsenic are frequently transported by the same hydrothermal fluids. When these fluids precipitate to form mineral deposits, gold is often hosted alongside arsenic-bearing minerals like arsenopyrite.

Because arsenic often creates a much larger geochemical halo than gold itself, identifying arsenic anomalies in regional till sampling allows “vectoring” toward the core of a mineralized system. At Kuhmo, the strong correlation between arsenic and major structural faults (Figure 3) providing a clear roadmap for drill testing.

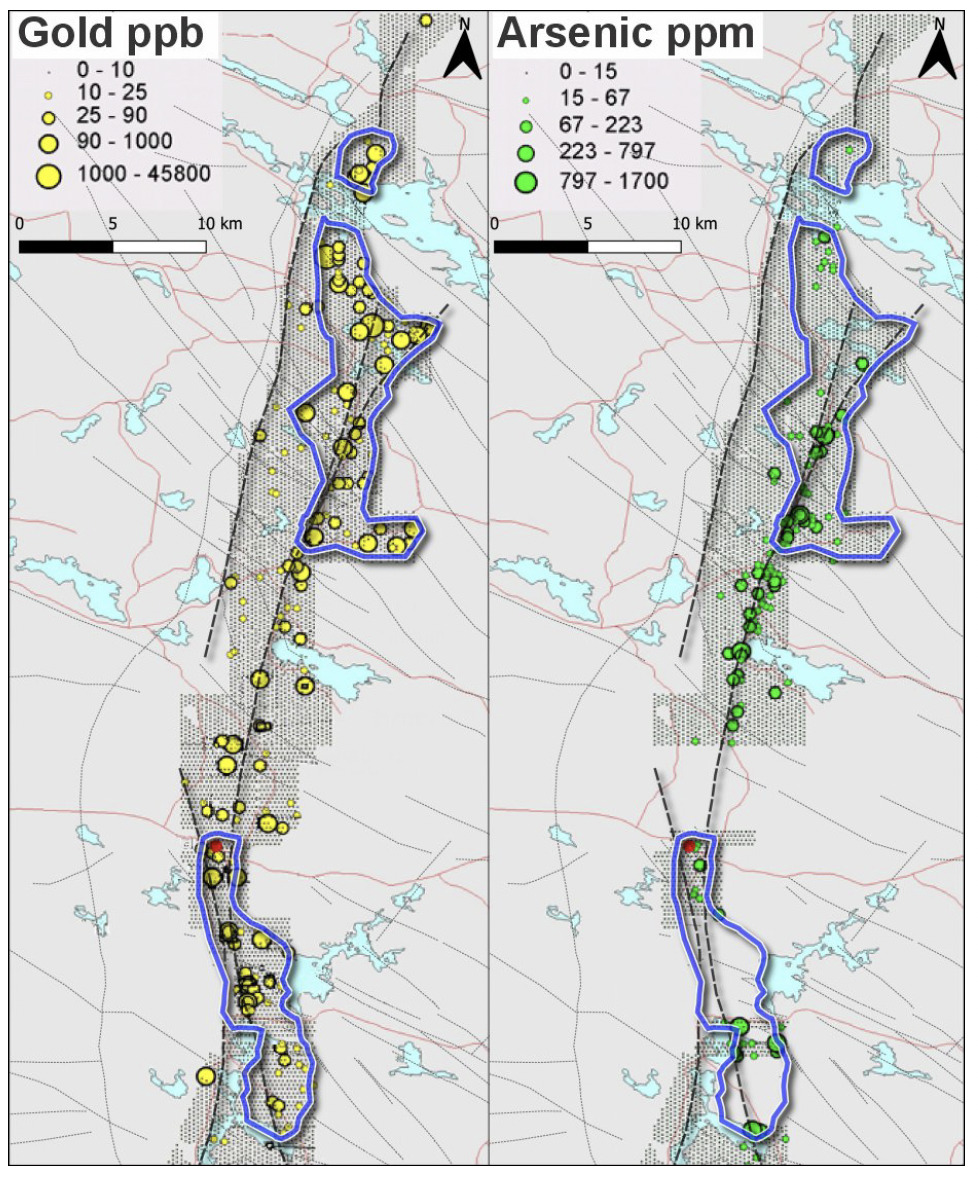

Potential also exists at Kuhmo for intrusion-related gold with arsenic-bismuth-tungsten-tellurium-in-till anomalies along the margin of a late felsic intrusive stock (Figure 4).

Nickel Mineralization: Historic Mineral Resources

Significantly, the belt hosts significant komatiite-associated nickel (Figure 2, Table 1 and 2.), with mineralization remaining open at depth at two known deposits and potential for other discoveries.

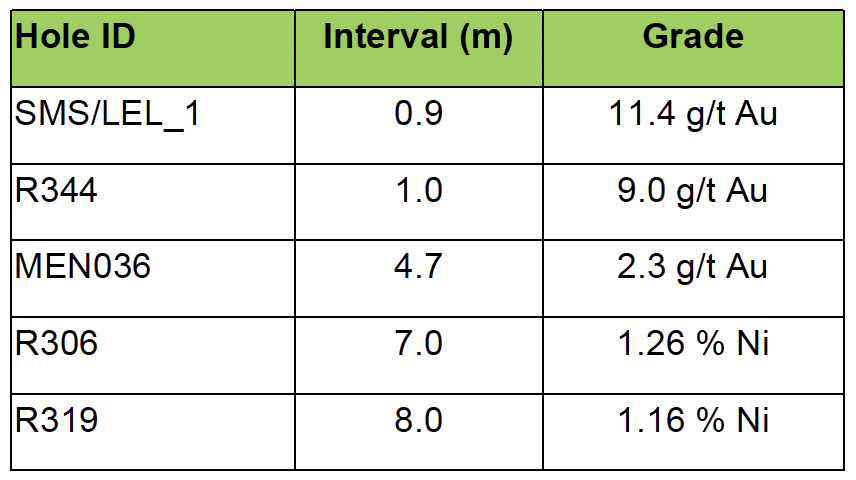

Table 1: Selected Historical Gold and Nickel Drill Intercepts

Sources: Geological Survey of Finland (GTK) Open Database.

Table 2: Historical Nickel Resource Estimates

Sources: 1. Internal Report, Outokumpu (1998). 2. Heino, T., 1998. HYRYNSALMI, Puistola 1 (kaivosrekisteri No 5657/1) ja Paatola 1 (kaivosrekisteri No 5619/1) nikkeliesiintymän mineraalivarantoarvio. Geological Survey of Finland, Archive report, M19/4421/-98/1/10, 33 pp.

Next Steps

GT Resources plans to initiate an exploration program to unlock the belt’s gold potential:

- Winter 2026: Re-logging and sampling of historical GTK core (targeting previously un-assayed gold zones).

- Spring/Summer 2026: Detailed magnetic survey, infill till sampling, and mapping.

- Fall 2026: Target compilation and drilling preparation.

Figure 1. Location Map of the Kuhmo Project and nearby Flagship LK Project

Figure 2. Simplified Geology map of the Kuhmo Project with notable gold and nickel occurrences and deposits.

Figure 3. GTK Till Sampling program showing gold and arsenic anomalies and their close relationship to major structures.

Figure 4. Gold-Arsenic and associated bismuth, tungsten, antimony, zinc and tellurium geochemical trends on the southern block of the Kuhmo Project, centered around a late felsic intrusive stock.

Disclaimer – Historical Resource Estimate – Sika-Aho and Arola Deposits

Readers are cautioned that the Company has not attempted to verify historic mineral resource estimates and therefore readers should not place any reliance on any historical estimate. A qualified person has not done sufficient work to classify a historical estimate as a current mineral resource; additionally, a qualified person has not yet determined what work needs to be done to upgrade or verify a historical estimate as current mineral resources or mineral reserves.

The Company is not treating any historical estimates as current mineral resources.

The Arola nickel deposit hosts a historic resource estimate of 1,500,000 tonnes grading 0.46% Ni1

The Sika-Aho nickel deposit hosts a historic resource of 175,000 tonnes grading 0.66% Ni using a 0.35% Ni cut-off2

References

11998 Outokumpu historic company report, not a Ni43-101 compliant historic mineral resource estimate.

2Heino, T., 1998. HYRYNSALMI, Puistola 1 (kaivosrekisteri No 5657/1) ja Paatola 1 (kaivosrekisteri No 5619/1) nikkeliesiintymän mineraalivarantoarvio. Geological Survey of Finland, Archive report, M19/4421/-98/1/10, 33 pp.

Qualified Person

The technical information in this release has been reviewed and verified by Neil Pettigrew, M.Sc., P.Geo., Vice President of Exploration and a director of the Company and the Qualified Person as defined by National Instrument 43-101.

About GT Resources

GT Resources Inc. (TSX-V: GT, OTCQB: CGTRF, FRA: 7N1) is a mineral exploration company focused on the discovery and de-risking of district-scale assets in world-class mining jurisdictions. The Company’s strategy is driven by a disciplined, science-based methodology designed to create shareholder value by advancing high-potential properties toward production within robust regulatory frameworks.

In Finland, the Company is advancing its flagship Läntinen Koillismaa (“LK”) Project, which hosts significant mineral resources including palladium, platinum, gold, copper, and nickel. In Canada, GT maintains a portfolio of earlier-stage, pre-resource projects targeting critical and precious metals. The quality and scale of the Company’s project portfolio has attracted strategic investment from Glencore plc, one of the world’s largest diversified natural resource companies.

Follow GT Resources on LinkedIn, Twitter, and at https://gtresourcesinc.com/.

ON BEHALF OF THE BOARD

Derrick Weyrauch”

President & CEO, Director

For further information contact:

Derrick Weyrauch, President & CEO or Neil Pettigrew, Vice President Exploration

Email: info@GTResourcesinc.com

Neither the TSX Venture Exchange nor its Market Regulator (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States of America. The common shares of GT Resources Inc. have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

Information set forth in this press release may contain forward-looking statements. Forward-looking statements are statements that relate to future, not past events. In this context, forward-looking statements often address a company’s expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, or other similar expressions. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in mineral and commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the absence of dividends; competition; dilution; the volatility of our common share price and volume; and the impact of governmental entities. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.